UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Information Required in Proxy Statement

Scheduled 14A Information

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

| Filed by the Registrant: ☒ | Filed by a Party other than the Registrant | o |

Check the appropriate box:

| Preliminary Proxy Statement |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material Pursuant to § 240.14a-12 |

TRIPLE-S MANAGEMENT CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

Triple-S Management Corporation1441Corporation

1441 F.D. Roosevelt Avenue -– San Juan, Puerto Rico 00920 2016

| Dear fellow Shareholder: |

It is my pleasure to invite you to our annual meeting of shareholders, which will be heldon Thursday, May 26, 2016,held on Friday, April 28, 2017, at 9:00 a.m., local time, in our corporate offices located at 1441 F.D.RooseveltF.D. Roosevelt Avenue, San Juan, Puerto Rico 00920.

At this year’s meeting, we will vote on the election of fourelect three directors to our Board of Directors, the ratification ofratify the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the current year, and2017, vote on a non-binding advisoryresolutionan advisory resolution to approve the compensation of the Company’s named executive officers. officers, vote on the frequency of future advisory votes on the compensation of the Company’s named executive officers, vote on several amendments to the Company’s Amended and Restated Articles of Incorporation, approve the Company’s 2017 Incentive Plan, and act on any other business matter properly brought before the meeting.

This booklet, which includes a formal notice of the meeting and the proxy statement, details the business to be conducted at the meeting and provides additional information about us and the meeting that you should consider as you castyourcast your vote. I appreciate the time and attention you devote to reading these materials and votingyourvoting your shares.

Your vote is very important to us. I encourage you to vote as soon as possible whether ornotor not you plan to attend the meeting. You may cast your vote over the Internet or by telephoneaccordingtelephone according to the instructions in the proxy statement and the notice. As an alternative, if yourequestedyou requested and received a printed copy of the proxy card by mail, you may complete, sign and datethedate the proxy card in accordance with the instructions set forth in the proxy statement. You may alsoreturnalso return the completed proxy card by mail in the postage-paid envelope provided with your request. Finally, I would like to acknowledge and commemorate our fellow director and vice chairof our Board, Ms. Adamina Soto-Martínez, who passed away on March 28, 2016. She madesignificant and lasting contributions to our Company and her presence on our Board will begreatly missed.

On behalf of the Board, thank you for your continued interest and support.Sincerely, LUISsupport.

Sincerely,

Luis A. CLAVELL-RODRÍGUEZ, MDChairClavell-Rodríguez, MD

Chair of the Board April 15, 2016

March , 2017

Triple-S Management Corporation

P.O. Box 363628

San Juan, Puerto Rico 00936-3628 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND PROXY STATEMENT |

To our Shareholders:

NOTICE IS HEREBY GIVEN that the 20162017 Annual Meeting of Shareholders will be held on Thursday,May 26, 2016,Friday, April 28, 2017, at 9:00 a.m., local time, in our corporate offices located at 1441 F.D. Roosevelt Avenue, San JuanPuertoJuan Puerto Rico 00920. Shareholders will be asked to consider and vote on the following matters: 1. The election of one nominee to serve as a “Group 2” director for a term of two years; 2. The election of three nominees to serve as “Group 3” directors, each for a term of three years; Items of business Record date Your vote is important 3. The ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the current year; 4. The consideration of an advisory resolution to approve the compensation of our named executive officers; and 5. Any other business that may properly come before the meeting or any adjournment or postponement thereof. Shareholders of record of the Company at the close of business on April 8, 2016 are entitled toreceive notice of, attend, and vote at the meeting. Please vote as promptly as possible by using the Internet, telephone, or by signing, dating andreturning the completed proxy card in accordance with the instructions in the Notice or yourproxy card.

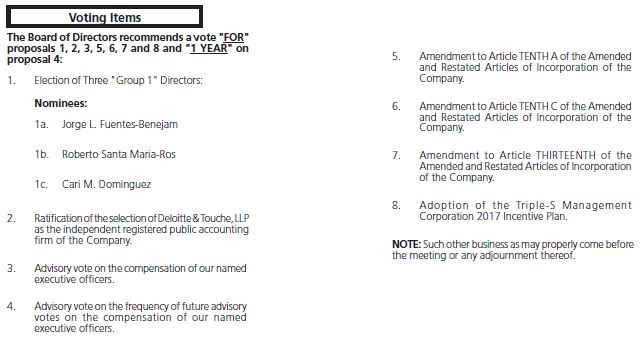

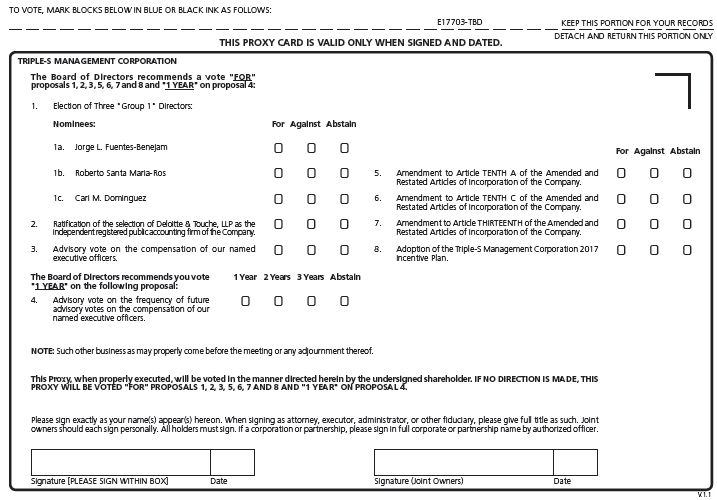

Items of business | Shareholders will be asked to consider and vote on the following matters: 1. The election of three nominees to serve as “Group 1” directors, each for a term of three years; 2. The ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for 2017; 3. The consideration of an advisory resolution to approve the compensation of our named executive officers; 4. The approval of an advisory vote on the frequency of future advisory votes on the compensation of our named executive officers; 5. The approval of an amendment to Article TENTH A of the Amended and Restated Articles of Incorporation of the Company; 6. The approval of an amendment to Article TENTH C of the Amended and Restated Articles of Incorporation of the Company; 7. The approval of an amendment to Article THIRTEENTH of the Amended and Restated Articles of Incorporation of the Company; 8. The adoption of the Triple-S Management Corporation 2017 Incentive Plan; and 9. Any other business that may properly come before the meeting or any adjournment or postponement thereof. | |

| Record date | Shareholders of record of the Company at the close of business on February 28, 2017 are entitled to receive notice of, attend, and vote at the meeting. | |

Your vote is important | Please vote as promptly as possible by using the Internet, telephone, or by signing, dating and returning the completed proxy card in accordance with the instructions in the Notice or your proxy card. |

Important notice regarding the availability of proxy materials This year we

We are delivering the proxy materials to all our shareholders via the Internet, as permitted by U.S.SecuritiesU.S. Securities and Exchange Commission rules. Instead of sending a paper copy of the proxy materials, we are sendingtosending to our shareholders of record a Notice of Internet Availability of Proxy Materials (the “Notice”) with instructions onhowon how to access the proxy materials and how to vote via the Internet.

Our proxy statement and the 20152016 annual report to shareholders are available at our website http://www.triplesmanagement.com.www.triplesmanagement.com. Shareholders may request a printed copy of the proxy materials by followingthefollowing the instructions set forth in the Notice and the proxy statement.

By order of the Board of Directors, CARLOS

Carlos L. RODRÍGUEZ-RAMOSSecretary Rodríguez-Ramos

Secretary

San Juan, Puerto RicoApril 15, 2016 Rico

March , 2017

| 1 | |

| 5 | |

| 6 | |

| 12 | |

| 12 | |

| 13 | |

| 14 | |

| 15 | |

| 16 | |

| 16 | |

| 16 | |

| 17 | |

| 18 | |

| 18 | |

| 20 | |

| 20 | |

| 21 | |

| 21 | |

| 22 | |

| 22 | |

| 22 | |

| 23 | |

| 24 | |

| 24 | |

| 28 | |

| 28 | |

| 29 | |

| 29 | |

| 29 | |

| 30 | |

| 30 | |

| 33 | |

| 34 | |

| 34 | |

| 35 | |

| 36 | |

| 37 | |

| 38 |

i

| 39 | |

| 39 | |

| 48 | |

| 49 | |

| 49 | |

| 50 | |

| 58 | |

| 59 | |

| 59 | |

| 60 | |

| 60 | |

| 60 | |

| 61 | |

| 61 |

This summary highlights certain information about Triple-S Management Corporation (the “Company,”“we, “we,” “our,” or “us”) and certain information contained elsewhere in this proxy statement for the Company’s 2016Annual2017 Annual Meeting of shareholders (“the meeting”). This summary does not contain all of the information that youshouldyou should consider. We encourage you to read the entire proxy statement carefully before voting.

Information about the meeting of shareholders Time and date: Thursday, May 26, 2016 at 9:00 a.m., local time. Location: 1441 F.D. Roosevelt Avenue, San Juan, Puerto Rico 00920. Record Date: Friday, April 8, 2016. Voting: All shareholders as of the record date are entitled to attend the meeting and vote. Each share of our common stock owned on the record date entitles the shareholder to one vote on each proposal presented for consideration. Board Page Voting matters recommendation reference Election of one “Group 2” director and three “Group 3” directors. FOR each nominee 11 Ratification of the selection of Deloitte & Touche LLP as FOR 15 independent registered public accounting firm. An advisory resolution to approve the compensation of our named FOR 17 executive officers.

| · | Time and date: | Friday, April 28, 2017 at 9:00 a.m., local time. |

| · | Location: | 1441 F.D. Roosevelt Avenue, San Juan, Puerto Rico 00920. |

| · | Record Date: | Tuesday, February 28, 2017. |

| · | Voting: | All shareholders as of the record date are entitled to attend the meeting and vote. Each share of our common stock owned on the record date entitles the shareholder to one vote on each proposal presented for consideration. |

| Voting matters | Board recommendation | Page reference | |

| · | Election of three “Group 1” directors. | FOR each nominee | 12 |

| · | Ratification of the selection of Deloitte & Touche LLP as the independent registered public accounting firm. | FOR | 16 |

| · | An advisory resolution to approve the compensation of our named executive officers. | FOR | 18 |

| · | An advisory vote on the frequency of future advisory votes on the compensation of our named executive officers. | 1 YEAR | 20 |

| · | Amendment to Article TENTH A of the Amended and Restated Articles of Incorporation of the Company. | FOR | 21 |

| · | Amendment to Article TENTH C of the Amended and Restated Articles of Incorporation of the Company. | FOR | 22 |

| · | Amendment to Article THIRTHEENTH of the Amended and Restated Articles of Incorporation of the Company. | FOR | 22 |

| · | Adoption of the Triple-S Management Corporation 2017 Incentive Plan. | FOR | 24 |

Director nominees

At the meeting, shareholders are being asked to vote for onethree “Group 2” director for a two-year term and forthree “Group 3”1” directors, each for a three-year term. Each nominee currently serves as a director in our Board. Also,our Board has determined that each nominee is independent pursuant to the independence criteria outlined by the NewYorkNew York Stock Exchange and the BlueCross and BlueShield Association. Director Name Age since Experience/Qualification Committee memberships David H. Chafey, Jr. 62 Manuel A. Figueroa-Collazo 64 Joseph A. Frick 63 Antonio F. Faría-Soto 67 Corporate governance highlights 2013 Banking and financial services expertise; public company knowledge; governmental experience 2004 Information technology expertise; international markets experience; executive leadership 2013 Health insurance expertise; public company knowledge; executive leadership 2007 Banking and financial services expertise; governmental experience; regulatory knowledge Investment and Financing (Chair) Audit Compensation and Talent Development (Chair) Corporate Governance and Nominating Corporate Governance and Nominating; Compensation and Talent Development Audit (Chair) Investment and Financing Executive 7 of our 9 current directors are independent.1 Separate chair of the Board and chief executive officer positions. Annual Board, committee, and individual director self-evaluations. Stock ownership guidelines for directors. Guidelines for annual continuing education of directors. 1 With the passing of Ms. Soto-Martínez on March 28, 2016, the Board currently consists of 9 members. Ms. Soto-Martínez’ seat on the Boardwill remain vacant while the Board considers a candidate for director.

| Name | Age | Director since | Experience/Qualification | Committee memberships |

| Jorge L. Fuentes Benejam | 68 | 2008 | Public company knowledge; executive leadership | · Corporate Governance and Nominating (Chair) · Investment and Financing · Executive |

| Roberto Santa María-Ros | 65 | 2015 | Accounting and Financial | · Audit · Investment and Financing |

| Cari M. Dominguez | 67 | 2012 | Government and public policy experience; human resources knowledge; executive leadership | · Corporate Governance and Nominating · Compensation and Talent Development · Executive (Vice Chair) |

Corporate governance highlights

| · | 7 of our 9 current directors are independent.1 |

| · | Separate chair of the Board and chief executive officer positions. |

| · | Lead Independent Director. |

| · | Annual Board, committee, and individual director self-evaluations. |

| · | Stock ownership guidelines for directors. |

| · | Guidelines for annual continuing education of directors. |

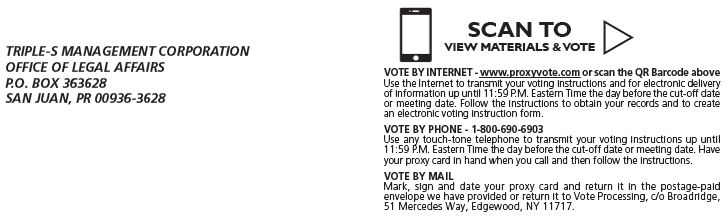

| Visit www.proxyvote.com and follow the instructions in the Notice. |

| Scan the QR Code in the Notice, with your mobile phone and vote following the instructions in the Notice. |

| Call the telephone number in the Notice. |

| Send your completed and signed proxy card to Triple-S Management Corporation c/o Broadridge Financial Solutions, Inc. at 51 Mercedes Way, Edgewood, New York 11717. |

| Cast your vote in person if you are the registered shareholder or by obtaining a “legal proxy” if your shares are held in “street name” by completing and signing your proxy card at the meeting. |

Submitting proposals for the 20172018 Annual Meeting of shareholders Deadline for shareholders proposal for inclusion in the 2017 proxy statement: December 16, 2016 Period for submitting proposals and nominations for directors to be considered at the 2017 Annual Meeting: December 28, 2016 to January 27, 2017.

| · | Deadline for shareholders proposal for inclusion in the 2018 proxy statement: | November 16, 2017 |

| · | Period for submitting proposals and nominations for directors to be considered at the 2018 Annual Meeting: | November 29, 2017 to December 29, 2017 |

Independent registered public accounting firm

As a matter of good corporate governance, our shareholders are being asked to ratify the selection of Deloitte& Touche LLP (“D&T”) as our independent registered accounting firm. Below is a summary of the fees that we paid or accruedinaccrued in connection with services provided by Deloitte & Touche LLP (“D&T”), our current independent registered publicaccounting firm&T for 2016 and PricewaterhouseCoopers LLP (“PwC”), our prior independent registered public accounting firmfor 2014. Type2015.

| Type of Fees | 2016 | 2015 | ||||||

| Audit Fees | $ | 2,902,600 | $ | 2,707,600 | ||||

| Audit-Related Fees | $ | 431,860 | $ | 340,250 | ||||

| Tax Fees | $ | 0 | $ | 0 | ||||

| All Other Fees | $ | 300,888 | $ | 0 | ||||

| Total | $ | 3,635,348 | $ | 3,047,850 | ||||

1 With the passing of Fees 2015 2014 Audit Fees $2,074,000 $4,441,000 Audit-Related Fees $318,000 $525,698 Tax Fees $0 $0 All Other Fees $0 $0 Total $2,392,000 $4,966,698 2

| PROXY SUMMARY |

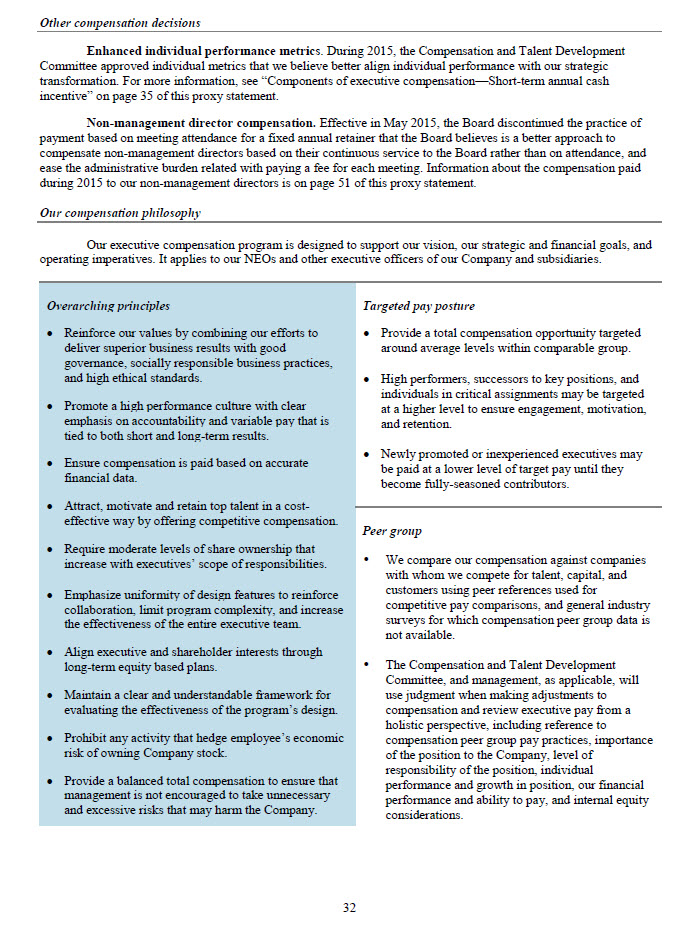

Components of our compensation plan are summarized below. Some components are inapplicable to certainexecutives,certain executives, as further described in this proxy statement. For more information on the compensation of our executiveofficers,executive officers, see the compensation“Compensation discussion and analysis beginning on page 30. Component Description Cash compensation to recognize individual contribution to the Company, taking into consideration the executive’s experience, knowledge and scopeanalysis” section of Fixed Base salary Short-term cashincentive Variable Equitycompensation responsibilities. Reviewed annually based on individual performance, the Company’s financial performance, and ability to pay. Adjusted if and when appropriate. Motivates individual to attain annual objectives and reinforces the optimization of operating results and corporate goals. May range from zero to 150% of the target opportunity. Company’s financial results account for 80% of each executive’s evaluation, and individual performance accounts for the remaining 20%. Promotes long-term success, the retention of talented individuals, and mitigation of excessive risk taking. 75% as performance shares; payout range from zero to 150% from target opportunity over a 3-year performance period. 25% as restricted shares vesting in equal installments over a 3-year period. Variable Benefits and perquisites including retirement programs, non-qualified deferred compensation plan,health and life insurance, and vehicle allowance, among others. this proxy statement.

| Component | Description | ||

| Fixed | Base salary | ·Cash compensation to recognize individual contribution to the Company, taking into consideration the executive’s experience, knowledge and scope of responsibilities. ·Reviewed annually based on individual performance, market-level relative salary, the Company’s financial performance, and ability to pay. ·Adjusted if and when appropriate. | |

| Variable | Short-term cash incentive | ·Motivates individual to attain annual objectives and reinforces the optimization of operating results and corporate goals. ·May range from zero to 150% of the target opportunity. ·Company’s financial results account for 70% of each executive’s evaluation, and individual performance accounts for the remaining 30%. | |

| Equity compensation | ·Promotes long-term success, the retention of talented individuals, and mitigation of excessive risk taking. ·75% as performance shares; payout range from zero to 150% from target opportunity over a 3-year performance period. ·25% as restricted shares vesting in equal installments over a 3-year period. | ||

| Variable | Benefits and perquisites including retirement programs, non-qualified deferred compensation plan, health and life insurance, and vehicle allowance, among others. | ||

Other components of the compensation program

Our compensation program includes policies and practices that we believe promote good governance andalignand align executive compensation with the interests of our shareholders.

What we do Have an equity grant policy with pre-scheduled grant dates to avoid backdating of equity awards. Deliver 75% of annual long-term incentive in the form of performance shares. Have an incentive compensation recoupment policy to ensure compensation is paid on accurate financial data. Require executive officers, directors and other individuals to request pre-clearance to transact with our stock. Engage an independent compensation consultant selected by, and that reports directly to, the Compensation and Talent Development Committee. Have stock ownership guidelines requiring executive and other participants of equity compensation to own and retain Company stock.

| · | Have an equity grant policy with pre-scheduled grant dates to avoid backdating of equity awards. |

| · | Deliver 75% of annual long-term incentive in the form of performance shares. |

| · | Have an incentive compensation recoupment policy to ensure compensation is paid on accurate financial data. |

| · | Require executive officers, directors and other individuals to request pre-clearance to transact with our stock. |

| · | Engage an independent compensation consultant selected by, and that reports directly to, the Compensation and Talent Development Committee. |

| · | Have stock ownership guidelines requiring executive and other participants of equity compensation to own and retain Company stock. |

What we don’t do No hedging on our Company stock. No unusual or excessive perquisites. No option awards. Grant of stock options was discontinued in 2010. No cash severance payment upon change in control. Chief executive officer may only receive cash severance payment upon a change in control with termination of employment (“Double trigger”). 3

| · | No hedging on our Company stock. |

| · | No unusual or excessive perquisites. |

| · | No option awards. Grant of stock options was discontinued in 2010. |

| · | No cash severance payment upon change in control. Chief executive officer may only receive cash severance payment upon a change in control with termination of employment (“Double trigger”). |

| PROXY SUMMARY |

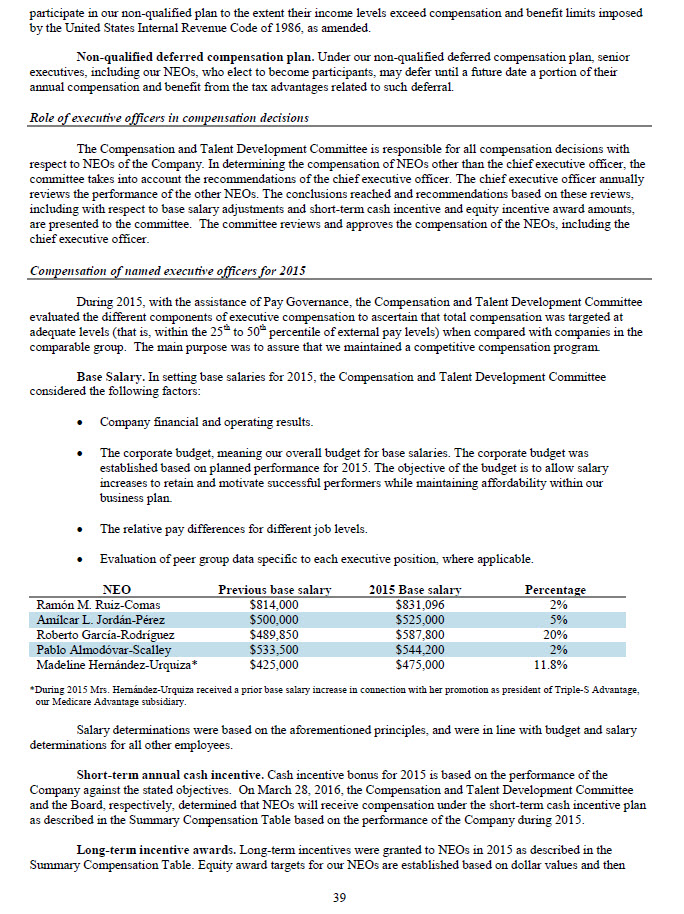

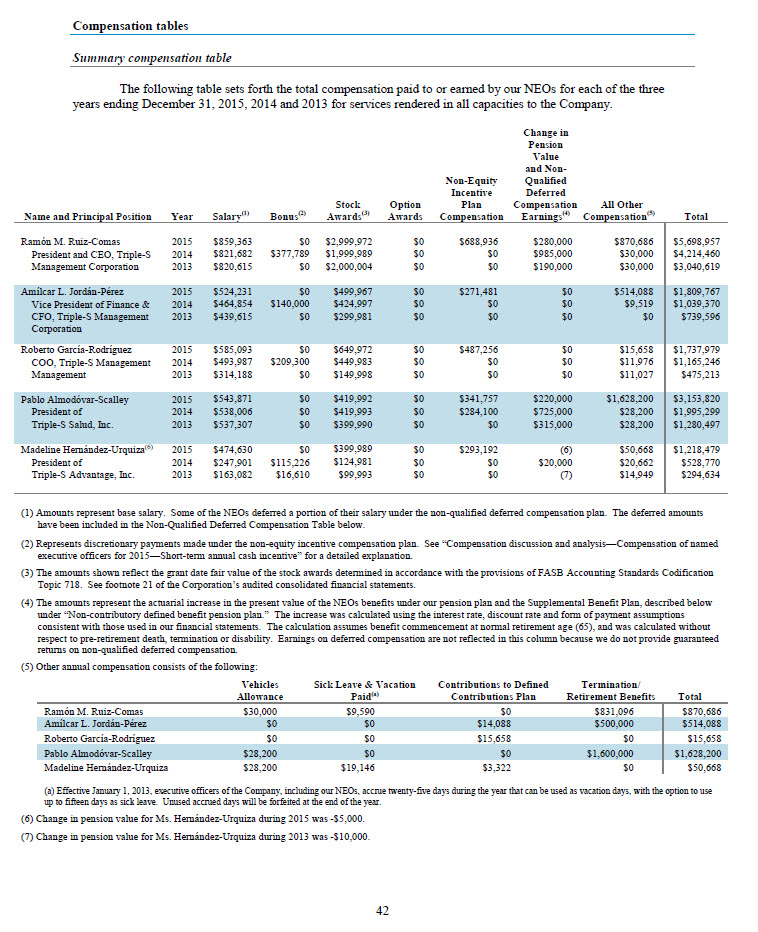

The compensation of our named executive officers (“NEOs”) for 20152016 is summarized below. For more information, see the narrative and notes accompanying the 20152016 summary compensation table set forth on page 42. Changetables included in Pension Value and Non- Non-Equity Qualified Stock Incentive Plan Deferred All Other Name and Position Salary Bonus Awards Compensation Compensation Compensation Total Ramón M. Ruiz-Comas $859,363 $0 $2,999,972 $688,936 $280,000 $870,686 $5,698,957 President and CEO Amílcar L. Jordán-Pérez $524,231 $0 $499,967 $271,481 $0 $514,088 $1,809,767 Vice President of Finance and CFO Roberto García-Rodríguez $585,093 $0 $649,972 $487,256 $0 $15,658 $1,737,979 Chief Operating Officer Pablo Almodóvar-Scalley $543,871 $0 $419,992 $341,757 $220,000 $1,628,200 $3,153,820 President of Triple-S Salud Madeline Hernández-Urquiza $474,630 $0 $399,989 $293,192 (1) $50,668 $1,218,479 President of Triple-S Advantage (1) Change in pension value for Ms. Hernández-Urquiza during 2015 was -$5,000. this proxy statement.

| Name and Position | Salary | Bonus | Stock Awards | Non-Equity Incentive Plan Compensation | Change in Pension Value and Non- Qualified Deferred Compensation | All Other Compensation | Total | |||||||||||||||||||||

Roberto García-Rodríguez President and CEO | $ | 744,385 | $ | 600 | $ | 1,874,972 | $ | 215,769 | $ | 0 | $ | 37,728 | $ | 2,873,454 | ||||||||||||||

Juan J. Roman-Jimenez Executive Vice President and CFO | $ | 471,154 | $ | 600 | $ | 749,981 | $ | 102,747 | $ | 45,000 | $ | 12,800 | $ | 1,382,282 | ||||||||||||||

| Madeline Hernandez-Urquiza | $ | 514,135 | $ | 600 | $ | 524,998 | $ | 150,186 | $ | 10,000 | $ | 33,683 | $ | 1,233,602 | ||||||||||||||

| President of Triple-S Salud & Triple-S Advantage, Inc. | ||||||||||||||||||||||||||||

| Eva G. Salgado-Micheo | $ | 391,516 | $ | 600 | $ | 374,979 | $ | 187,995 | $ | 180,000 | $ | 28,200 | $ | 1,163,290 | ||||||||||||||

| President of Triple-S Propiedad, Inc. | �� | |||||||||||||||||||||||||||

| Arturo L. Carrion-Crespo | $ | 324,700 | $ | 600 | $ | 249,978 | $ | 153,760 | $ | 0 | $ | 44,000 | $ | 773,038 | ||||||||||||||

| President of Triple-S Vida, Inc. | ||||||||||||||||||||||||||||

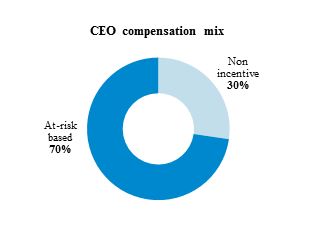

Compensation mix

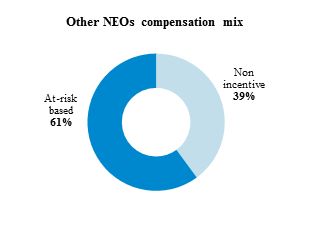

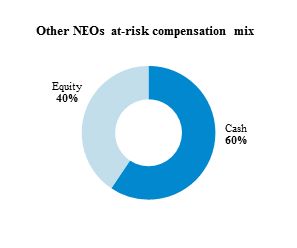

For 2015, 72.5%2016, 70% of the total compensation approved to our CEO and 60.4%61% for our other NEOs was at-risk,variable compensation. Actual amounts realized depend on our annual and long-term performance and ourCompany’sour Company’s stock price. Also, equity compensation granted comprised more than two-thirds63% of CEO compensation andmore than a thirdand 40% of all other NEOs compensation. We believe this compensation design promotes our executives toachieveto achieve the Company’s financial results while taking into consideration the impact of their decisions. ThecompensationThe compensation mix of our CEO and our other NEOs is illustrated in the charts below, which considers maximumpayoutmaximum payout of approved performance equity grants and cash compensation. CEO compensation mix Non incentive 27.5% At-risk based 72.5% Other NEOs compensation mix Non incentive At-risk 39.6% based 60.4% CEO at-risk compensation mix Cash 29.2% Equity 70.8% Other NEOs at-risk compensation mix Equity 39.9% Cash 60.1% 4

We are providing this proxy statement to our shareholders in connection with a solicitation of proxies by theBoardthe Board of Directors (the “Board”) of the Company for use at the meeting and at any adjournment or postponement oftheof the meeting. We will hold the meeting on Thursday, May 26, 2016,Friday, April 28, 2017, beginning at 9:00 a.m., local time, in our corporateofficescorporate offices located at 1441 F.D. Roosevelt Avenue, San Juan, Puerto Rico 00920.

We are furnishing the proxy materials over the Internet pursuant to the rules of the U.S. Securities and Exchange Commission (“SEC”). On or about April 15, 2016,March 16, 2017, we began mailing the Notice to our shareholders ofrecordof record as of the close of business of April 8, 2016.on February 28, 2017. The Notice contains instructions on how to access this proxystatementproxy statement and our annual report and how to cast your vote. You will not receive a paper copy of the proxy materialsunlessmaterials unless you request one. The Notice will contain instructions on how to access the proxy materials over the Internet andvoteand vote online or by telephone. The Notice also contains instructions on how to request a paper copy of our proxymaterials,proxy materials, free of charge.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on May 26, 2016:April 28, 2017: This proxy statement, our 20152016 Annual Report, the form of proxy and voting instructions are being made available to shareholders of record of our Class A and Class B common stock on orabout April 15, 2016or about March 16, 2017 at www.proxyvote.com.www.proxyvote.com. If you would still like to receive a printed copy of the proxy materials orour 2015or our 2016 Annual Report, including audited financial statements for the year ended December 31, 2015,2016, you mayrequestmay request a printed copy by: (a) telephone at 1-800-579-1639; (b) Internet at www.proxyvote.com;www.proxyvote.com; or (c) e-mail atsendmaterial@proxyvote.com.at sendmaterial@proxyvote.com. Please make the request as instructed above on or before MayApril 14, 20162017 to facilitatetimelyfacilitate timely delivery.

All proxies will be voted in accordance with the instructions they contain. If you do not provide voting instructions on your proxy card with respect to a particular matter, your shares will be voted in accordance with therecommendationsthe recommendations of our Board. 5

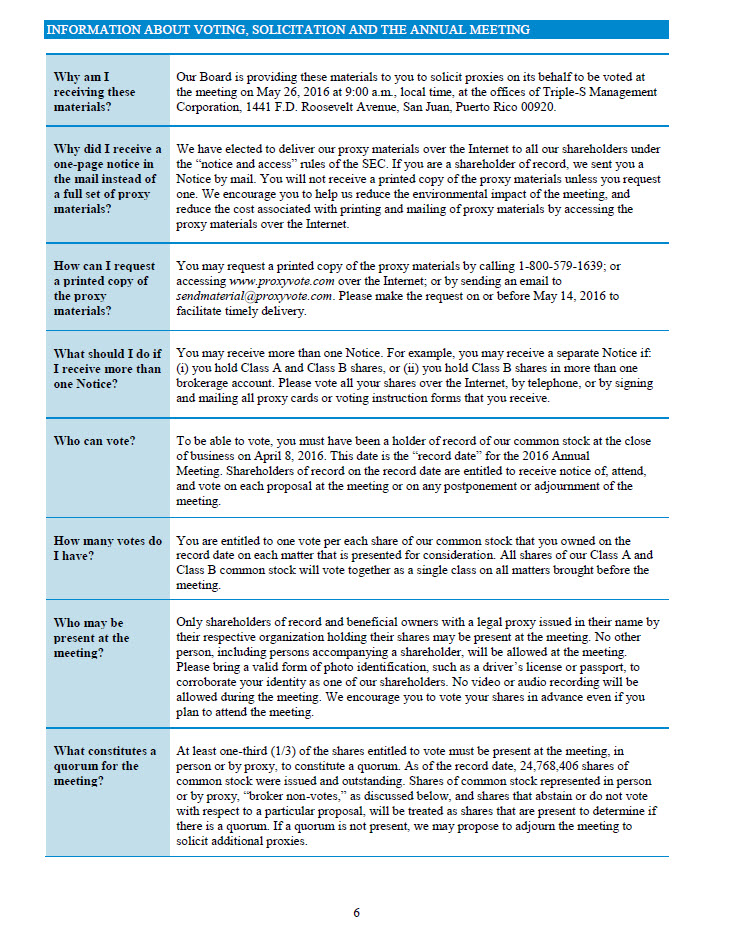

Why am I receiving these materials? | Our Board is providing these materials to you to solicit proxies on its behalf to be voted at the meeting on April 28, 2017 at 9:00 a.m., local time, at the offices of Triple-S Management Corporation, 1441 F.D. Roosevelt Avenue, San Juan, Puerto Rico 00920. | |||

Why did I receive a one-page notice in the mail instead of a full set of proxy materials? | We have elected to deliver our proxy materials over the Internet to all our shareholders under the “notice and access” rules of the SEC. If you are a shareholder of record, we sent you a Notice by mail. You will not receive a printed copy of the proxy materials unless you request one. We encourage you to help us reduce the environmental impact of the meeting, and reduce the cost associated with printing and mailing of proxy materials by accessing the proxy materials over the Internet. | |||

How can I request a printed copy of the proxy materials? | You may request a printed copy of the proxy materials by calling 1-800-579-1639; or accessing www.proxyvote.com over the Internet; or by sending an email to sendmaterial@proxyvote.com. Please make the request on or before April 14, 2017 to facilitate timely delivery. | |||

What should I do if I receive more than one Notice? | You may receive more than one Notice. For example, you may receive a separate Notice if: (i) you hold Class A and Class B shares, or (ii) you hold Class B shares in more than one brokerage account. Please vote all your shares over the Internet, by telephone, or by signing and mailing all proxy cards or voting instruction forms that you receive. | |||

Who can vote? | To be able to vote, you must have been a holder of record of our common stock at the close of business on February 28, 2017. This date is the “record date” for the 2017 Annual Meeting. Shareholders of record on the record date are entitled to receive notice of, attend, and vote on each proposal at the meeting or on any postponement or adjournment of the meeting. | |||

How many votes do I have? | You are entitled to one vote per each share of our common stock that you owned on the record date on each matter that is presented for consideration. All shares of our Class A and Class B common stock will vote together as a single class on all matters brought before the meeting. | |||

Who may be present at the meeting? | Only shareholders of record and beneficial owners with a legal proxy issued in their name by their respective organization holding their shares may be present at the meeting. No other person, including persons accompanying a shareholder, will be allowed at the meeting. Please bring a valid form of photo identification, such as a driver’s license or passport, to corroborate your identity as one of our shareholders. No video or audio recording will be allowed during the meeting. We encourage you to vote your shares in advance even if you plan to attend the meeting. | |||

What constitutes a quorum for the meeting? | At least one-third (1/3) of the shares entitled to vote must be present at the meeting, in person or by proxy, to constitute a quorum. As of the record date, shares of common stock were issued and outstanding. Shares of common stock represented in person or by proxy, “broker non-votes,” as discussed below, and shares that abstain or do not vote with respect to a particular proposal, will be treated as shares that are present to determine if there is a quorum. If a quorum is not present, we may propose to adjourn the meeting to solicit additional proxies. |

What is the difference between a shareholder of record and a beneficial owner of shares held in street name? | Shareholder of record. If your shares of common stock are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, and not through a brokerage firm, bank, broker-dealer or other similar organization, you are considered the “shareholder of record” with respect to those shares. We have sent the Notice directly to you. Beneficial owner of shares held in street name. If your shares are held in an account at a brokerage firm, bank, broker-dealer or other similar organization, then you are the “beneficial owner” of shares held in “street name,” and a Notice should be sent to you by that organization. You have the right to instruct that organization how to vote your shares. | |||

How do I vote if I am the shareholder of record of my shares? | If you are the shareholder of record, you may vote in one of the following four ways: ·Through the Internet. Vote by following the instructions on the Notice or going to the Internet address stated on your proxy card. ·By telephone. Call the telephone number provided on your proxy card. ·By mail. If you requested and received a printed copy of the proxy materials or downloaded the proxy materials over the Internet, you can complete and sign your proxy card and mail it to the following address: Triple-S Management Corporation c/o Broadridge Financial Solutions, Inc. 51 Mercedes Way Edgewood, New York 11717 ·In person. Attend the meeting and vote in person or by submitting your proxy card at the meeting. Completing and sending the proxy card. Provide your full title when signing a proxy as attorney-in-fact, executor, administrator, trustee, guardian, authorized officer of a corporation, or on behalf of a minor to ensure your proxy card is voted according to your instructions and to avoid delays in ballot taking and counting. If shares are registered in the name of more than one record holder, all record holders must sign the proxy card. If you vote via the Internet or by phone, do not return the proxy card. Closing of voting facilities. The Internet and telephone voting facilities will close at 11:59 p.m., Eastern time, on April 27, 2017. If you plan to vote by mail, your proxy card must be received no later than 12:00 p.m., Eastern Time, on April 27, 2017. | |||

How do I vote if I am a “beneficial owner”? | If you are a beneficial owner you will receive the Notice from the organization that holds your shares with instructions on how to vote your shares. That organization will allow you to deliver your voting instructions via the Internet and may also permit you to submit your voting instructions by telephone. In addition, you may request paper copies of our proxy statement and proxy card by following the instructions on the Notice provided by the organization. You can vote in person at the meeting, but you must bring at the meeting a “legal proxy” issued in your name by the organization that holds your shares. The legal proxy authorizes you to vote your shares held in street name at the meeting. Contact the organization that holds your shares for instructions on how to obtain a legal proxy. You must bring a copy of the legal proxy to the meeting and ask for a ballot in order to cast your vote in person. In order for your vote to be counted, you must hand the copy of the legal proxy with your completed ballot when you cast your vote. |

Can I change or revoke my vote after I have voted? | Yes. You can change your vote or revoke your proxy at any time before the taking of votes at the meeting by delivering a written notice of revocation to our Secretary at or before the meeting; or by submitting another proxy by mail, telephone or the Internet prior to the applicable cutoff time; or by presenting to our Secretary, before or at the meeting before polls close, a later dated proxy executed by the person who executed the prior proxy; or by voting in person at the meeting. If you elect to revoke your vote by delivering a written notice of revocation or by submitting another proxy by mail to our Secretary, deliver it to the following address: Triple-S Management Corporation c/o Carlos L. Rodríguez-Ramos, Secretary 1441 F.D. Roosevelt Avenue, 6th Floor San Juan, Puerto Rico 00920 If you provide more than one proxy, the properly signed proxy having the latest date will revoke any earlier proxy. Attending the meeting will not automatically revoke a proxy unless you properly vote at the meeting or specifically request that your prior proxy be revoked. If you are a beneficial owner, you must contact the organization that holds your shares to change your vote or, if you intend to be present and vote at the meeting, bring the legal proxy issued in your name by such organization to the meeting. | |||

What happens if I do not give specific voting instructions? | If you are a shareholder of record and you indicated when voting on the Internet or by telephone that you wish to vote as recommended by the Board, or you signed and returned a proxy card without giving specific voting instructions, then the persons named as proxy holders will vote your shares in the manner recommended by the Board on all matters presented in this proxy statement and, as proxy holders, may determine in their discretion with respect to any other matters properly presented for a vote at the meeting and at any postponement or adjournment thereof. If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions then, under applicable rules, the organization that holds your shares may generally vote on “routine” matters but cannot vote on “non-routine” matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization will inform the inspector of election that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a “broker non-vote.” In order to minimize the number of broker non-votes, the Company encourages you to vote or provide voting instructions with respect to each proposal to the organization that holds your shares by carefully following the instructions provided in the Notice or voting instruction form. | |||

Who will count the votes? | A representative of Broadridge Financial Solutions, Inc., an independent third party, will act as the inspector of the election and tabulate the votes cast by proxy or in person at the meeting. | |||

Which proposals are considered routine or non-routine? | The election of directors (Proposal 1), the advisory resolution to approve the compensation of our NEOs (Proposal 3), the advisory vote on the frequency of the advisory vote on the compensation of our NEOs (Proposal 4), the approval of the amendments to the Amended and Restated Articles of Incorporation of the Company (Proposal 5, Proposal 6, Proposal 7), and the approval of the Triple-S Management 2017 Incentive Plan (Proposal 8) are considered non-routine matters under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore broker non-votes may exist in connection with Proposals 1 and Proposal 3 through 8. The ratification of the selection of D&T as our independent registered public accounting firm for 2017 (Proposal 2) is considered a routine matter under applicable rules. A broker or other nominee may generally vote on routine matters, and therefore it is likely that no broker non-votes will exist in connection with Proposal 2. |

What is the required vote to approve each proposal? | Election of directors (Proposal 1). A nominee must be elected to our Board by the affirmative vote of a majority of votes cast with respect to such nominee by the shares of common stock entitled to vote and present at the meeting or represented by proxy. If shareholders do not elect a nominee who is already serving as a director, Puerto Rico corporation law provides that the director will continue to serve on our Board as a “holdover” director until a successor is elected. An “affirmative vote of a majority of votes cast” on a proposal means that the votes cast “for” the proposal exceed the votes cast “against” such proposal. Abstentions and broker non-votes will not count as a vote “for” or “against” the proposal and thus will have no effect in determining whether the proposal has received the affirmative vote of a majority of the votes cast at the meeting. Ratification of the selection of the independent registered public accounting firm (Proposal 2). The approval of this proposal requires the affirmative vote of the holders of a majority of the shares of common stock entitled to vote and present at the meeting or represented by proxy. Abstentions will have the same effect as votes “against” this proposal and broker non-votes will have no effect on the proposal. Approval of the compensation of our named executive officers (Proposal 3). The approval, on an advisory basis, of this proposal requires the affirmative vote of the holders of a majority of the shares of common stock entitled to vote and present at the meeting or represented by proxy. Abstentions will have the same effect as votes “against” this proposal and broker non-votes will have no effect on this proposal. Advisory vote on the frequency of future advisory votes on the compensation of our named executive officers (Proposal 4). The approval of this proposal requires the affirmative vote of the holders of a majority of the shares of common stock entitled to vote and present at the meeting or represented by proxy. Abstentions will have the same effect as votes “against” this proposal and broker non-votes will have no effect on this proposal. With respect to this proposal, if none of the frequency alternatives receive a majority vote, we will consider the frequency that receives the highest number of votes by shareholders to be the frequency that has been selected by shareholders. However, because this vote is advisory and not binding on us or our Board in any way, our Board may decide that it is in our and our shareholders’ best interests to hold an advisory vote on executive compensation more or less frequently than the alternative approved by our shareholders. Approval of the Amendments to the Amended and Restated Articles of Incorporation of the Company (Proposal 5, Proposal 6 and Proposal 7). The approval of these proposals require the affirmative vote of a majority of the issued and outstanding shares of common stock, entitled to vote, as of the record date. Abstentions and broker non-votes will have the same effect as votes “against” these proposals. Additionally, the failure to vote will have the same effect as a vote “against” these proposals. Adoption of the Triple-S Management 2017 Incentive Plan (Proposal 8). The approval of this proposal requires the affirmative vote of the holders of a majority of the shares of common stock entitled to vote and present at the meeting or represented by proxy. Abstentions will have the same effect as votes “against” this proposal and broker non-votes will have no effect on this proposal. |

How does the Board recommend to vote on the proposals? | The Board recommends shareholders to vote as set forth below. Election of Directors (Proposal 1). FOR each of the three nominees. Ratification of the selection of the independent registered public accounting firm (Proposal 2). FOR the ratification of D&T as our independent registered public accounting firm for 2017. Approval of the compensation of our named executive officers (Proposal 3). FOR the approval, on an advisory basis, of the compensation of our named executive officers. Advisory vote on the frequency of future advisory votes on the compensation of our named executive officers (Proposal 4). 1 YEAR on the frequency of future advisory votes on the compensation of the Company’s named executive officers. Amendment to Article TENTH A of the Amended and Restated Articles of Incorporation of the Company (Proposal 5). FOR the approval of the amendment to Article TENTH A the Amended and Restated Articles of Incorporation of the Company. Amendment to Article TENTH C of the Amended and Restated Articles of Incorporation of the Company (Proposal 6). FOR the approval of the amendment to Article TENTH C the Amended and Restated Articles of Incorporation of the Company. Amendment to Article THIRTEENTH of the Amended and Restated Articles of Incorporation of the Company (Proposal 7). FOR the approval of the amendment to Article THIRTEENTH of the Amended and Restated Articles of Incorporation of the Company. Adoption of the Triple-S Management 2017 Incentive Plan (Proposal 8). FOR the adoption of the Triple-S Management 2017 Incentive Plan. | |||

Will any other business be conducted on at this meeting? | We do not know of any other business that may come before the meeting other than as described in the Notice. The chair of the meeting will declare out of order and disregard the conduct of any business not properly presented. However, if any new matter requiring the vote of our shareholders is properly presented before the meeting, proxies may be voted with respect thereto at the discretion of the proxy holders. The affirmative vote of the holders of a majority of the shares of common stock entitled to vote and present at the meeting or represented by proxy with respect to any other item properly presented at the meeting will be required for approval of such item, unless a greater percentage is required by law, our articles of incorporation or our bylaws. | |||

Where can I find the voting results of the meeting? | We will announce preliminary voting results at the meeting and publish voting results in a Current Report on Form 8-K, which will be filed with the SEC within four business days following the meeting. | |||

What is the cost and method of soliciting proxies? | We will bear the costs of soliciting proxies. We will also reimburse banks, brokers or other custodians, nominees and fiduciaries representing beneficial owners for their reasonable out-of-pocket expenses incurred in distributing proxy materials to shareholders and obtaining their votes. In addition, our directors, officers and employees may solicit proxies on the Company’s behalf in person, by telephone, or email without additional compensation. | |||

What happens if the meeting is postponed or adjourned? | Your proxy will still be valid and may be voted at the postponed or adjourned meeting. You will still be able to change or revoke your proxy at any time before it is voted. |

How and when may I submit a shareholder proposal, including a shareholder nomination for director, for the 2018 annual meeting of shareholders? | If you are interested in submitting a proposal for inclusion in the proxy statement for the 2018 annual meeting of shareholders, you need to follow the procedures outlined in Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). To be eligible for inclusion, we must receive the shareholder’s proposal for our proxy statement for the 2018 annual meeting of shareholders at our principal corporate offices in San Juan, Puerto Rico, at the address below no later than November 16, 2017. In addition, our bylaws require that we be given advance written notice of director nominations for election to our Board and other matters that shareholders wish to present for action at an annual meeting, other than those to be included in our proxy statement under Rule 14a-8 of the Exchange Act. The Secretary must receive such notice from a shareholder of record at the address noted below not less than 120 days or more than 150 days before the first anniversary of the preceding year’s annual meeting. However, if the date of our annual meeting is advanced by more than 30 days, or delayed by more than 60 days, from the anniversary date, then we must receive such notice at the address noted below not later than the close of business on the tenth day after the day on which public disclosure of the meeting was made. Assuming that the 2018 annual meeting is not advanced by more than 30 days nor delayed by more than 60 days from the anniversary date of the meeting, you would need to give us appropriate notice of the proposal at the address noted below no earlier than the close of business on November 29, 2017, and no later than the close of business on December 29, 2017. If a shareholder of record does not provide timely notice of a nomination or other matters to be presented at the 2018 annual meeting, it will not appear in the notice of meeting. If you are a beneficial owner, you can contact the organization that holds your shares for information about how to register your shares directly in your name as a shareholder of record. Our bylaws also specify requirements relating to the content of the notice that shareholders of record must provide to our Secretary for any matter, including a shareholder proposal or nomination for director, to be properly presented at a shareholder meeting. A copy of the full text of our bylaws is on file with the SEC and available on our website at www.triplesmanagement.com. Any proposals, nominations or notices should be sent to: Triple-S Management Corporation c/o Carlos L. Rodríguez-Ramos, Secretary 1441 F.D. Roosevelt Avenue, 6th Floor San Juan, Puerto Rico 00920 |

Recommendation:Vote FOR each for a three-year term until the 2019 annualmeeting or until a successor is elected and qualified. Recommendation: Vote FOR each nominee.

Our Board is divided into three groups, with one group being elected each year and members of each groupholdinggroup holding office for a three-year term. This classified board structure is required by our articles of incorporation and by the terms of ourlicenseour license agreement with the BlueCross and BlueShield Association (“BCBSA”). Our Board has fixed the number ofdirectorsof directors at ten. With the passing of Ms. Adamina Soto-Martínez on March 28, 2016, the Board currently consists ofnineof nine members: twothree Group 1 directors (with terms expiring at the 2017 annual meeting), two Group 2 directors (withterms(with terms expiring at the 2018 annual meeting), fourthree Group 3 directors (with terms expiring at the 20162019 annual meeting)and our president and chief executive officer, which is an ex-officio member of our Board and is excluded from thethreethe three director groups.groups pursuant to the articles of incorporation of the Company. At this annual meeting our shareholders will have the opportunity to vote on an amendment to the articles of incorporation of the Company to eliminate the provision by which the Company’s President and chief executive officer is a member of the Board without shareholder approval (Proposal 6). Ms. Soto-Martínez’nez’s seat on the board will remainremains vacant while the Board considers a candidateforcandidate for director.

Our articles of incorporation and our license with the BCBSA require our Board to be comprised of three groups as equal in number as possible. Our bylaws authorize the Board to alter the total number of directors serving onouron our Board, fix the exact number of directors serving in each group, nominate directors for shorter terms of office, andassignand assign nominees to a specific group to ensure that the group size requirement is met. Accordingly, the Boardnominated one individual to serve as a Group 2 director for a two-year term andBoard nominated three individuals to serve as Group 3directors,1 directors, each for a three-year term. Nominees are current directors. The affirmative vote of a majority of the votescastvotes cast by the shares of common stock entitled to vote and present or represented by proxy at the meeting is required toelectto elect each nominee.

The persons named as proxies in the proxy card will vote for each of these nominees unless you instructotherwiseinstruct otherwise on the proxy card. Nominees have indicated their willingness and ability to serve, if elected. However, ifanyif any or all of the nominees should be unable or unwilling to serve, the proxies may be voted for a substitute nomineedesignatednominee designated by our Board or our Board may reduce the number of directors. Proxies cannot be voted for a greaternumbergreater number of persons than the number of nominees. We have no knowledge that any nominee will become unavailableforunavailable for election.

Information about the nominees and directors continuing in office

The following candidates for election have been nominated by the Board based on the recommendation oftheof the Corporate Governance and Nominating Committee. Below you will find information about the nominees and directorswhosedirectors whose terms in office will continue after the meeting, have given us aboutincluding their age, positions held, their principaloccupation,principal occupation, business experience and directorships (including positions held in our Board’s committees, if any) for atleastat least the past five years. In addition, we have included information regarding each nominee’s and director’s specificexperience,specific experience, qualifications, attributes and skills that led our Board to conclude that the nominees and directors shouldserveshould serve as members of the Board. We believe that all of our nominees and directors have a reputation forof integrity, honesty and adherence to high ethical standards. Also, they each have demonstrated business acumen and an ability toexerciseto exercise sound judgment, as well as a commitment of service to the Company, which taken as a whole, enable theBoardthe Board to satisfy its oversight responsibilities in light of our business and structure.

The information presented about each nominee for election and director continuing in office is as of the dateofdate of this proxy statement. Information about the number of shares of common stock beneficially owned by each of thenomineesthe nominees and directors appears below under the heading “Security ownership of certain beneficial owners andmanagement.and management.” See also “Other relationships, transactions and events.” There are no family relationships among any ofourof our directors and executive officers. We encourage our shareholders to read the “Corporate Governance andNominating Committee――Director nominations process” section of this proxy, at page 24, for further details. 11

Nominees for election Nominee for Group 2 for a two-year term Joseph A. Frick Professional background: Mr. Frick is the executive vice chair of Diversified Director since 2013 Search, a national executive search firm, since May 2011. He is also the vice chair of Independent the board of directors of Independence Blue Cross, a health insurance company, Age: 63 where he previously served as president and chief executive officer from 2005 to 2010 and as senior vice president of human resources and administration from 1993 to 2005. He is member of the board of directors of BioTelemetry, Inc., a publicly-tradedcompany, since October 2013. Before serving in Independence Blue Cross, he workedin various management positions within the publishing and the electronics industries.He also served on the boards of directors of BCBSA and America’s Health InsurancePlans, among others. He is a NACD Board Leadership Fellow. Qualifications: Mr. Frick’s significant experience as an executive and a director inseveral companies with similar businesses as ours and in a publicly-traded companyprovides an invaluable perspective to our Board. Committee positions: Member of the Corporate Governance and NominatingCommittee and the Compensation and Talent Development Committee. Nominees for Group 3, each for a three-year term David H. Chafey, Jr. Professional background: Mr. Chafey was the chair of the board of directors of the Director since 2013 Government Development Bank for Puerto Rico from January 2013 to June 2015. Independent Previously, he served as president and chief operating officer of Popular, Inc., a Age: 62 publicly traded financial holding company, from 2009 to 2010, and president of Banco Popular de Puerto Rico, a subsidiary of Popular, Inc., from 2004 to 2010. Healso served in various senior executive positions within Popular, Inc., including chieffinancial officer and executive vice president. Mr. Chafey also served in severalboards of directors, including Popular, Inc., VISA Latin American and Caribbean, andVISA International. He is a NACD Board Leadership Fellow. Qualifications: Mr. Chafey’s governmental experience, operational managementskills in the banking and financial industry, financial acumen, and executiveleadership in a publicly traded company provide critical insight into business andfinancial matters to our Board. Committee positions: Chair of the Investment and Financing Committee, member ofthe Audit Committee and the Executive Committee. Manuel Figueroa- Professional background: Mr. Figueroa-Collazo is the president of VERNET, Inc., Collazo, an educational software development company, since 1999. He has over thirty years PE, PhD of experience in senior management positions and over twenty-five years of exposure Director since 2004 at all management levels in the computer, information and telecommunications Independent industries. He was chief executive officer for Lucent Technologies, Mexico and a Age: 64 department head at AT&T Bell Laboratories. He is a NACD Board Leadership Fellow. Qualifications: Mr. Figueroa-Collazo brings to our Board considerable experience ininformation technology, international markets, and executive management insight,which is critical to our business. Committee positions: Chair of the Compensation and Talent Development Committee; member of the Corporate Governance and Nominating Committee andthe Executive Committee 12

Nominees for Group 1, each for a three-year term | ||

Jorge L. Fuentes-Benejam, PE Director since 2008 Independent Age: 68 | Professional background: Mr. Fuentes-Benejam was chair, president and chief executive officer from 1986 until 2010, and is currently chair of Gabriel Fuentes Jr. Construction Co. Inc., a heavy and marine construction business, and of Fuentes Concrete Pile Co. Inc., a precast concrete pile manufacturing business, and related entities. Currently, Mr. Fuentes-Benejam is a member of the board of trustees of Interamerican University of Puerto Rico, Puerto Rico’s largest private university. Mr. Fuentes-Benejam is a NACD Board Leadership Fellow. Qualifications: Mr. Fuentes-Benejam’s broad understanding of Puerto Rico’s business environment, particularly the construction industry—one of the key industries we serve—as well as his considerable management and board experience, which includes his past service on the board of Puerto Rico Cement Company, a former publicly-traded company, provides a wealth of knowledge to us as a public company. Board and Committee positions: Chair of the Corporate Governance and Nominating Committee; member of the Investment and Financing Committee and the Executive Committee. | |

Roberto Santa María-Ros Director since 2015 Independent Age: 65 | Professional background: Mr. Santa María-Ros was managing partner of the San Juan, Puerto Rico office of Pricewaterhouse Coppers, LLC (PwC), until his retirement in 2012. He joined PwC in 1973 and was admitted to the partnership in 1988. In 2004, he was appointed partner-in-charge of PwC’s audit practice division as well as managing partner of the San Juan Office. Previously, he served solely as managing partner of the San Juan Office from 2008 to 2012. He currently serves as member of the boards of the Ángel Ramos Foundation and of the Puerto Rico chapter of United Way Worldwide. Qualifications: Mr. Santa María-Ros’ vast experience with a major accounting firm and his understanding of accounting and finance principles are strong attributes for our Board. Board and Committee positions: Member of the Audit Committee and the Investment and Financing Committee. | |

Cari M. Dominguez, PhD Director since 2012 Independent Age: 67 | Professional background: Mrs. Dominguez is president of Dominguez & Associates, a management consulting firm, since 2007. Prior to that, Mrs. Dominguez held several leadership positions in the public and private sectors, including chair of the United States Equal Employment Opportunity Commission from 2001 to 2006, Partner of Heidrick & Struggles, a consulting firm, from 1995 to 1998, Director of Spencer Stuart, a consulting firm, from 1993 to 1995 and Assistant Secretary for Employment Standards, and Director of the Office of Federal Contract Compliance Programs of U.S. Department of Labor, from 1989 to 1993. She also held a series of executive positions with Bank of America from 1984 to 1989. Mrs. Dominguez serves as a director of Manpower Group, Inc., a global workforce solutions provider, since 2007, and is a member of its compensation and human resources committee. She also serves as a trustee of Calvert SAGE Funds since 2008, and a director, faculty member, and Board Leadership Fellow of the NACD. Qualifications: Mrs. Dominguez has extensive experience in government relations and labor markets from her various governmental positions. She also brings executive, international, and operational experience in the human resources industry. Her expertise in workforce preparedness, human resources management, corporate governance, social responsibility, and public policy are of increasing importance to our company. Board and Committee positions: Vice Chair and Lead Independent Director of the Board and Member of the Corporate Governance and Nominating Committee and the Compensation and Talent Development Committee. | |

Group 2 Directors (terms expire at the 2018 annual meeting) | ||

Luis A. Clavell-Rodríguez, MD Director since 2006 Not independent Age: 65 | Professional background: Dr. Clavell-Rodriguez is the chief executive officer of the Comprehensive Cancer Center of the University of Puerto Rico since 2015 and chief medical officer and president of the Professional Board at San Jorge Children’s Hospital in San Juan, Puerto Rico since 1994. He is the principal investigator for the Children’s Oncology Group, a clinical trial organization, and the Puerto Rico National Cancer Institute Oncology Community Research Program, organizations sponsored by the National Cancer Institute. He is also a professor of pediatrics and cancer medicine at the University of Puerto Rico’s School of Medicine. He has particular expertise in translational research, and health delivery research and policy. He is a NACD Board Leadership Fellow. Qualifications: Dr. Clavell-Rodriguez’ profound understanding of the managed care business and his more than thirty years of professional experience in the medical field, including the administration of medical facilities and related entities, provide valuable insight for our Board. Board and Committee positions: Chair of the Board and the Executive Committee and member of the Investment and Financing Committee. | |

Joseph A. Frick Director since 2013 Independent Age: 64 | Professional background: Mr. Frick is currently a senior advisor to Diversified Search, a national executive search firm. From May 2011 to October 2016, he served as executive vice chair of the firm. He is also a board and executive committee member of Independence Blue Cross, a health insurance company, where he previously served as president and chief executive officer from 2005 to 2010 and as senior vice president of human resources and administration from 1993 to 2005. He is member of the board of directors of BioTelemetry, Inc., a publicly-traded company, since October 2013. Before serving in Independence Blue Cross, he worked in various management positions within the publishing and the electronics industries. He also served on the boards of directors of BCBSA and America’s Health Insurance Plans, among others. He is a NACD Board Leadership Fellow. Qualifications: Mr. Frick’s significant experience as an executive and a director in several companies with similar businesses as ours and in a publicly-traded company provides an invaluable perspective to our Board. Committee positions: Member of the Corporate Governance and Nominating Committee and the Compensation and Talent Development Committee. | |

Group 3 Directors (terms expire at the 2019 annual meeting) | ||

David H. Chafey, Jr. Director since 2013 Independent Age: 62 | Professional background: Mr. Chafey is a member of the administrative board of the Puerto Rico Dairy Industry Development Fund and director of Industria Lechera de Puerto Rico, Inc. (Indulac) since July 2016. Mr. Chafey was the chair of the board of directors of the Government Development Bank for Puerto Rico from January 2013 to June 2015. Previously, he served as president and chief operating officer of Popular, Inc., a publicly traded financial holding company, from 2009 to 2010, and president of Banco Popular de Puerto Rico, a subsidiary of Popular, Inc., from 2004 to 2010. He also served in various senior executive positions within Popular, Inc., including chief financial officer and executive vice president. Mr. Chafey also served in several boards of directors, including Popular, Inc., VISA Latin American and Caribbean, and VISA International. He is a NACD Board Leadership Fellow. Qualifications: Mr. Chafey’s governmental experience, operational management skills in the banking and financial industry, financial acumen, and executive leadership in a publicly traded company provide critical insight into business and financial matters to our Board. Committee positions: Chair of the Investment and Financing Committee, member of the Audit Committee and the Executive Committee. | |

Manuel Figueroa-Collazo, PE, PhD Director since 2004 Independent Age: 65 | Professional background: Mr. Figueroa-Collazo is the president of VERNET, Inc., an educational software development company, since 1999. He has over thirty years of experience in senior management positions in the computer, information and telecommunications industries. He was chief executive officer for Lucent Technologies, Mexico and a department head at AT&T Bell Laboratories. He is a NACD Board Leadership Fellow. Qualifications: Mr. Figueroa-Collazo brings to our Board considerable experience in information technology, international markets, and executive management insight, which is critical to our business. Committee positions: Chair of the Compensation and Talent Development Committee; member of the Corporate Governance and Nominating Committee and the Executive Committee. | |

Antonio F. Faría-Soto Director since 2007 Independent Age: 68 | Professional background: Mr. Faría-Soto held several senior positions within the commercial and investment banking industry until his retirement in 2006 and prominent positions in the government of Puerto Rico until 2004. He served as chair of the board of directors and chief executive officer of Doral Bank, from 2005 to 2006, and as president of the Government Development Bank for Puerto Rico from 2003 to 2004. He also served as president of the Economic Development Bank for Puerto Rico from 2002 to 2003, and before that, as Commissioner of Financial Institutions of Puerto Rico. He is a NACD Board Leadership Fellow. Qualifications: Mr. Faría-Soto’s broad understanding of the banking and financial industry, government regulation and public affairs, as well as his proven executive leadership provides a valuable perspective to our Board. Board and Committee positions: Chair of the Audit Committee; member of the Investment and Financing Committee and the Executive Committee | |

Roberto García-Rodríguez Director since 2016 Management Age: 53 | Professional background: Mr. García-Rodríguez has served as the Company’s president and chief executive officer since January 2016. He served as the Company’s chief operating officer from December 2013 to December 2015 and as the Company’s vice president of legal affairs and general counsel from May 2008 to December 2013. Mr. García-Rodríguez is a NACD Board Leadership Fellow. Qualifications: Mr. García-Rodríguez brings executive leadership, operational expertise and legal acumen to our Board. |

Pursuant to our current articles of incorporation, Mr. García-Rodríguez is a director of the Company by virtue of being our president and chief executive officer. Mr. García-Rodríguez is not included in the three groups into whichourwhich our Board is divided. As an ex-officio director, Mr. García-Rodríguez’ membership inon our Board is not subject toshareholderto shareholder approval and the shareholders may not remove him from officehis board position while he is our president and chiefexecutivechief executive officer. 14

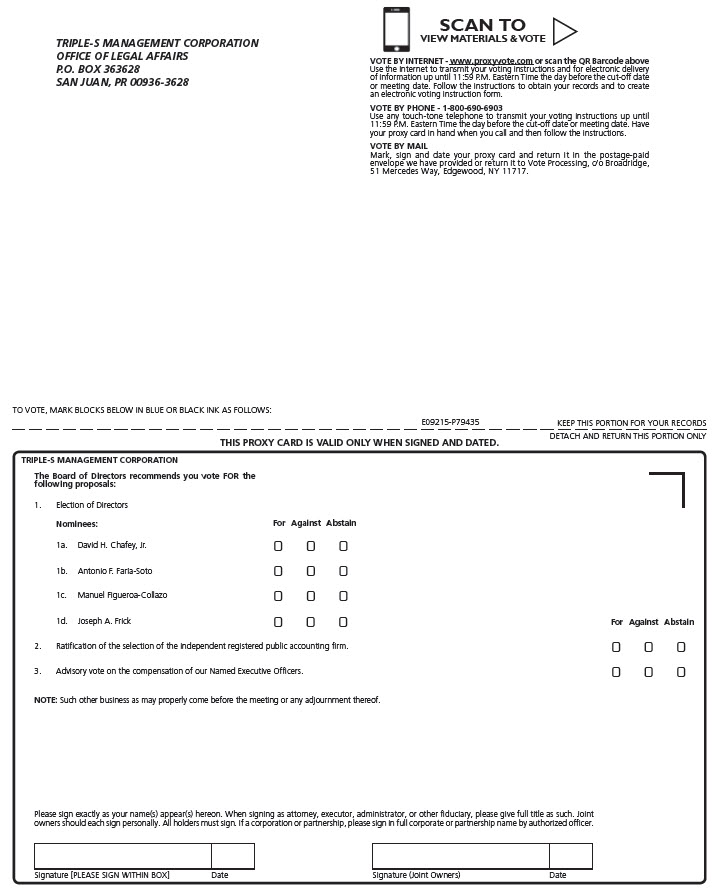

Recommendation: | Vote FOR the proposal. |

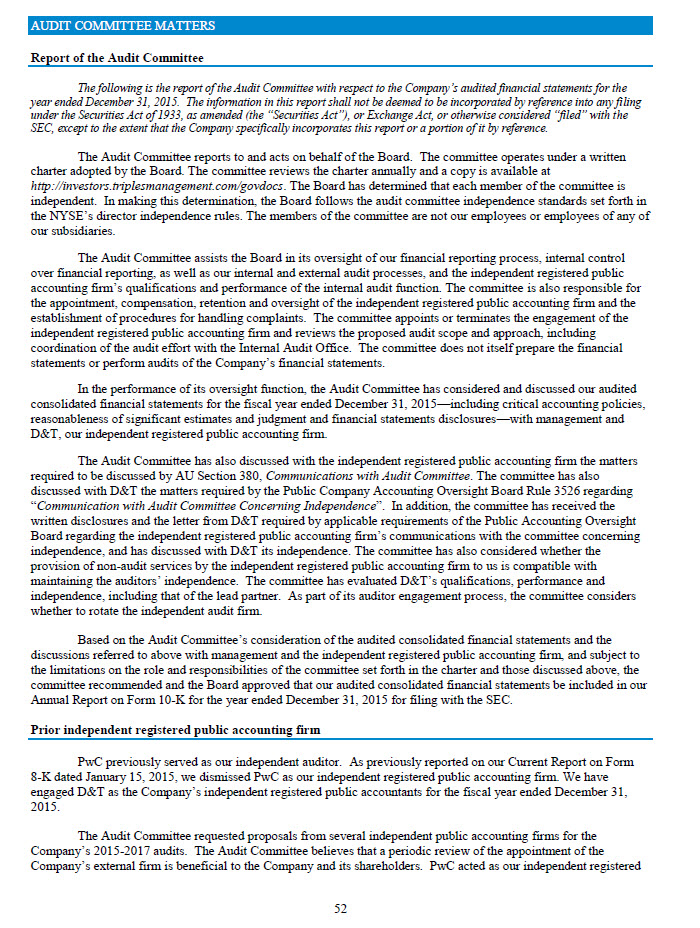

Current law, rules, and regulation, as well as the charter of the Audit Committee, require the Audit Committee to engage, retain, and supervise our independent registered accounting firm. Although ratification by ourshareholdersour shareholders is not required by our bylaws or otherwise, the Board believes submitting the selection of D&T is amattera matter of good corporate governance. If shareholders fail to ratify the selection, the Audit Committee will reconsiderwhetherreconsider whether or not to retain D&T. Even if the selection is ratified, the Audit Committee in its discretion may select adifferenta different registered public accounting firm at any time during the year if it determines that such a change would be inourin our best interests and those of our shareholders. Representatives of D&T are expected to attend the meeting and willbewill be given an opportunity to make a statement if so desired and to respond to appropriate questions.

The affirmative vote of the holders of a majority of votes cast with respect to this proposal by the shares of common stockentitledstock entitled to vote and present or represented by proxy at the meeting is required to ratify the selection of D&T as theCompany’sthe Company’s independent registered public accounting firm for the current year. 2017.

The following is a description of the fees we paid or accrued for the professional services rendered by ourcurrentD&T, our auditors D&T, for the yearyears ended December 31, 20152016 and PwC, our prior independent registered publicaccounting firm, for the year ended December 31, 2014: 2015:

Audit fees.fees. The audit fees for the year ended December 31, 2016 and 2015 and 2014 were forcorresponded to professional services rendered by D&T and PwC, respectively, for the integrated audits of our annual consolidated financial statements andsystemand system of internal control over financial reporting, reviews of the financial statements included in our quarterly reportsonreports on Form 10-Q, and statutory audits required of our subsidiaries. Total fees related to the audit of the financialstatementsfinancial statements as of and for the years ended December 31, 2016 and 2015 were $2,902,600 and 2014 were $2,074,000 and $4,441,000,$2,707,600, respectively. Included in the 2016 and 2015 audit fees are $19,000$92,600 and $56,400 corresponding to the recently enacted value addedsales and use tax inPuertoin Puerto Rico for certain designated professional services. The sales and use tax incurred in 2015 but billed in 2016 amounts to $37,400. The audit fees for the year ended December 31, 2014 include$250,0002015 include $450,000 of additional fees billed by the accounting firm during 20152016 after our submission of last year’s proxystatement. Expensesproxy statement. Audit related expenses corresponding to the year ended December 31, 20152016 amount to $75,000.$112,000. For the year endedDecemberended December 31, 2014,2015, expenses incurred amounted to $91,000,$116,450, including $66,000$41,450 billed in 2016 but corresponding to 2015.

Also, for the year ended December 31, 2015, we paid $130,000, including $5,000 in expenses billed in 2015 butcorrespondingconnection with the preparation of certain supplemental schedules to 2014. the financial statements required in Puerto Rico. For 2016, the fees related to the preparation of the supplemental schedules to the financial statements are included in the audit fees detailed above.

Audit-related fees.fees. The audit-related fees for professional services rendered by D&T and PwC for the yearsendedyears ended December 31, 2016 and 2015 were $431,860 and 2014 were $318,000 and $525,698,$340,250, respectively. The audit-related fees related toprocedurescorrespond to procedures performed for SSAE 16 (Statement of Standards for Attestation Engagements-Reporting on Controls atServiceat Service Organizations) audits, which amounted to $165,000$306,000 and $300,000,$166,000, respectively. Expenses, including the sales and use tax related to the SSAE 16amounted16 amounted to $3,000$12,240 and $698,$9,250 for 2016 and 2015, respectively. Also, for the year ended December 31, 2014, we paid $225,000 inconnection with to the preparation of supplemental schedules required in Puerto Rico, including $50,000 paid in 2015in excess of the estimate provided by the auditors. For 2015,The fees related to the preparation of supplemental schedulesrequired in Puerto Rico are estimated at $175,000. During 2015, fees related to an auditaudits performed by D&T of theFederalthe Federal Employees Health Benefit Plan amounted to $100,000.$109,500 and $100,000 in 2016 and 2015, respectively. The 2016 fees include expenses in the amount of $6,500 billed in 2017. The corresponding sales and use tax for 2016 and 2015 amounted to $4,120 and $4,000, respectively. In 2015, the Puerto Rico Health InsuranceAdministrationInsurance Administration requested an audit of the Government Health Insurance Plan as of June 30, 2015. The amount paid forthis2015, which audit was $50,000. amounted to $53,000, of which $3,000 corresponded to expenses.

Tax fees.fees. No professional tax services were rendered by D&T and PwC for the years ended December 31,201531, 2016 and 2014. 2015.

All other fees. fees. For the year ended December 31, 2016, we paid D&T $246,885 in fees related to D&T’s assistance in the readiness to obtain a report for SSAE 16 (Statement of Standards for Attestation Engagements-Reporting on Controls at Service Organizations) type 2 for HITRUST. Expenses and the related sales and use tax amounted to $42,431 and $11,572, respectively. No other services were rendered by D&T and PwC for the yearsyear ended December 31, 2015and 2014. 15

2015.

The Audit Committee must pre-approve all auditing and non-audit services rendered by our independent registered public accounting firm. Pre-approval, however, is not required for non-audit services if: (1) the aggregatedollaraggregate dollar value of such services does not exceed five percent of the total fees paid by the Company to the externalauditorsexternal auditors during the fiscal year in which the non-audit services are provided; (2) we did not recognize such services asnon-auditas non-audit services at the time of the engagement; and (3) such services are promptly brought to the attention of andapprovedand approved by the Audit Committee prior to the completion of the audit. In accordance with the foregoing, the AuditCommitteeAudit Committee pre-approved all audit and non-audit services provided by D&T in 2015. 16

“RESOLVED, that the shareholders approve, on an advisory basis, the compensation of our named executive officers, as disclosed in ‘Compensation Disclosure—Compensation discussionanddiscussion and analysis,’ the compensation tables and the narrative discussion contained in our 2016 proxystatement.2017 proxy statement.” Recommendation: Vote FOR the proposal.

Recommendation: | Vote FOR the proposal. |

In 2011, our shareholders voted that the compensation of our NEOs be presented to our shareholders on anannualan annual basis. Our Board accepted our shareholders’ advisory vote, and in this proxy statement, we are asking ourshareholdersour shareholders to provide advisory approval of the compensation of our NEOs, as such compensation is described in thesectionthe section titled “Compensation Disclosure” beginning on page 30 of this proxy statement. Our next vote on thefrequency of shareholders’ advisory vote will be held no later than the 2017 annual meeting.

Our executive compensation program is designed to enable us to attract, motivate and retain executive talent,which is critical to our success. We seek to accomplish this goal in a way that rewards performance and is aligned withourwith our shareholders’ long-term interests. We encourage our shareholders to review the information in “CompensationDisclosure—“Compensation Disclosure—Compensation discussion and analysis” of this proxy statement, the executive-related compensationtablescompensation tables and the narrative disclosures that accompany the compensation tables for more detailed information on ourexecutiveour executive compensation program and the decisions made by the Compensation and Talent Development Committee in2015. in 2016.

The following is a summary of some elements of the executive compensation program: Competitive pay within best practices. Compensation aims to reflect best practices. Total executive compensation is regularly compared by our Compensation and Talent Development Committee with totalcompensation levels for equivalent positions at companies of similar size and complexity. Balanced compensation mix. Total compensation—which includes base salary, short and long-term variable pay opportunities, benefits and perquisites—is generally between the 25th and 50th percentile ofthe comparable group of companies. A significant percentage of total compensation is delivered in theform of incentive compensation. Appropriate reward of short-term performance. Cash incentive focuses on the achievement of various financial, management and individual objectives. Maximum payment of NEOs’ cash incentive is limitedto 150% of their respective target opportunity, based on their base salary. Equity compensation focused on long-term performance. 75% of the equity award value is granted in the form of performance shares and the remaining 25% in the form of time-based restricted stock. Performance shares vest at the end of a three-year performance period and restricted shares vest in equal proportions over a three-year period. Annual review of chief executive officer and other executive officers performance. The Compensation and Talent Development Committee has direct responsibility to oversee the performance of the chief executive officer. The committee also discusses with the chief executive officer the performance of those executives and other personnel under his direct report as part of the committee determinations on executive compensation. 17

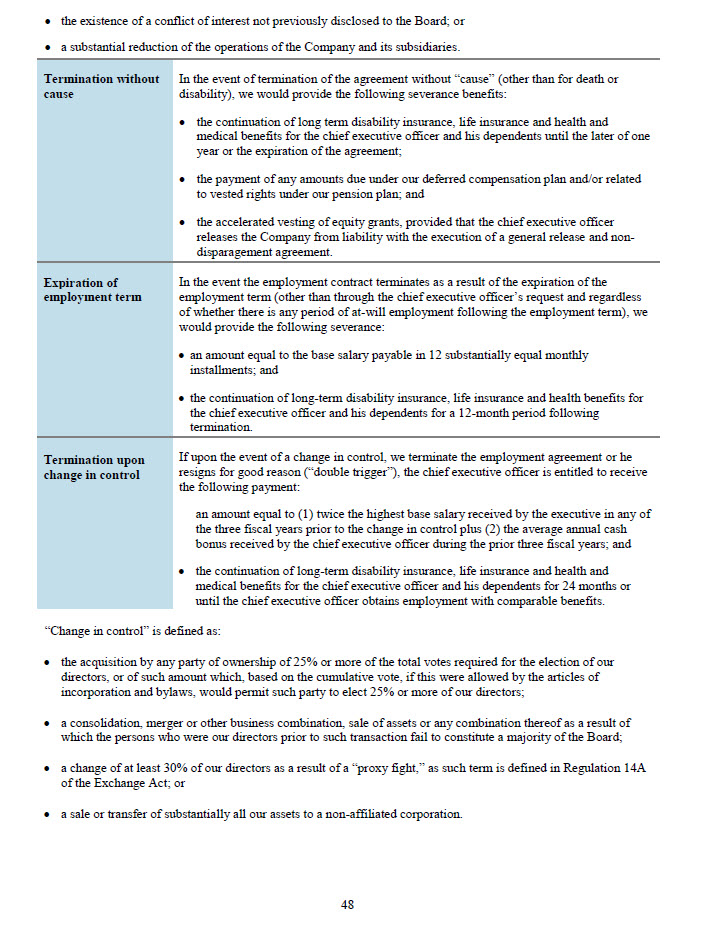

| · | Competitive pay within best practices. Compensation aims to reflect best practices. Total executive compensation is regularly compared by our Compensation and Talent Development Committee with total compensation levels for equivalent positions at companies of similar size and complexity. |